the haunting of credit card debt: a scary story about escaping the interest abyss

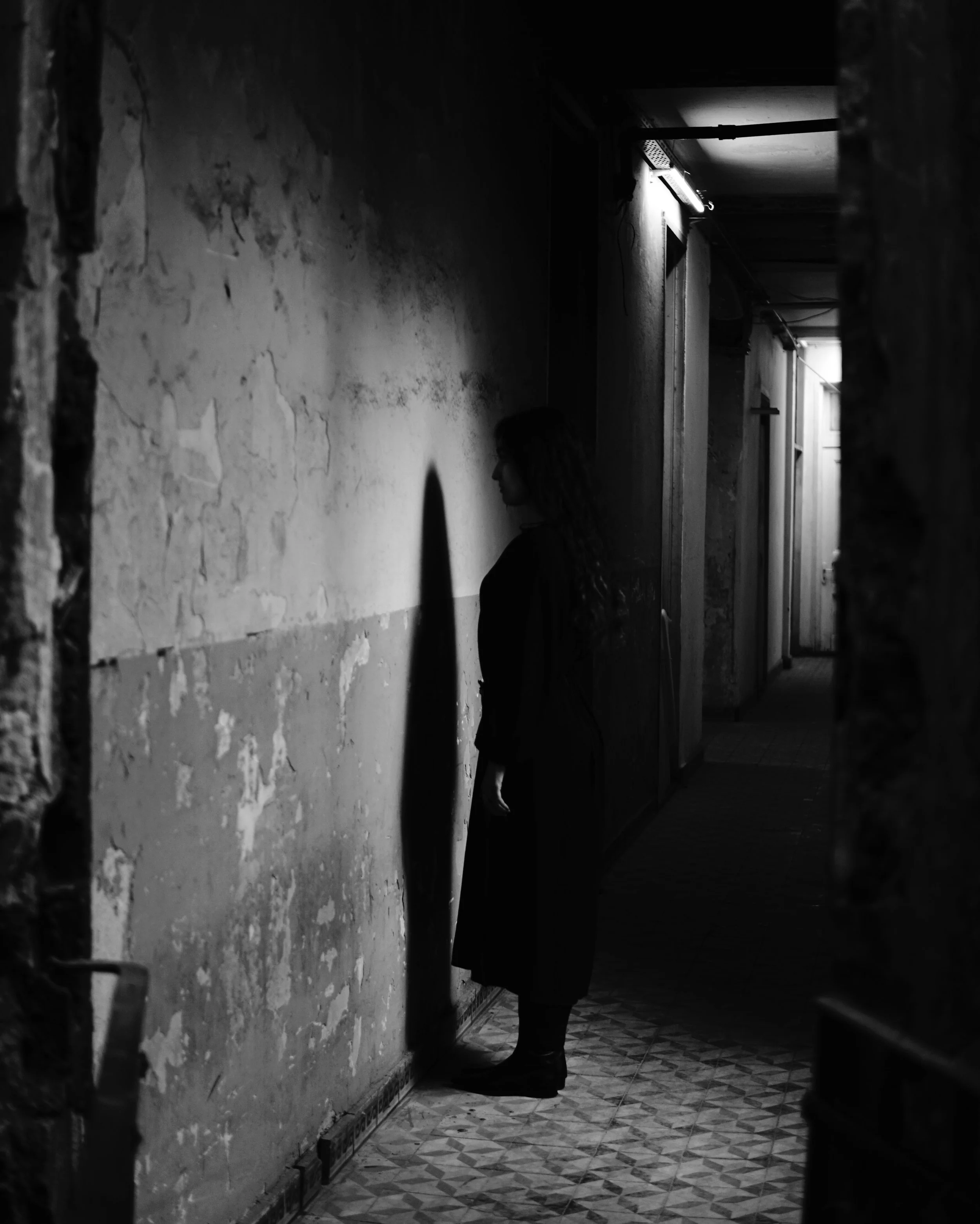

In the dimly lit corridors of personal finance, one ominous presence casts a long, chilling shadow over the lives of many—a sinister apparition known as credit card debt. On this spooky night, l will share with you a nightmare about how Sarah escaped the clutches of credit card debt.

This nightmare is a cautionary tale of impulse buying. Sarah is a young professional who, like many, fell victim to the allure of credit cards. With each unnecessary purchase, she fed the spirits of debt that haunted her finances. Her initial credit utilization seemed harmless, but as her debt grew, a haunting realization dawned. She was drowning in a sea of interest payments and ran out of credit to spend.

Six months after maxing out her credit cards, the home next to Sarah’s parents was listed on the market. This property was a multifamily property that would generate Sara an extra thousand dollars in passive income. Sarah was denied a mortgage due to her debt-to-income ratio and credit score. She could not progress financially because of the weight of debt. She became desperate to make more money and spend less money to fix her credit and reach financial freedom. Sarah learned the hard way that good credit creates access to opportunities whereas debt blocks your entry… Sarah was terrified.

By embracing a minimalist approach and practicing mindfulness in spending, she banished the ghosts of impulsive buying from her life. To conquer the demons of debt that haunted her, Sarah utilized debt consolidation, direct deposit, automated balance transfers, and a commitment to cutting unnecessary expenses. Through perseverance and a disciplined budget, Sarah not only paid off her debt but also emerged wiser and more financially resilient. It took Sarah years to get out of the debt she had created in months.

This is a compelling reminder that the road to financial wellness is not always without its twists and turns. Credit card debt, like a relentless ghost, can loom over us, but the tales of those who've faced this ghoul with courage and strategy show us the path to liberation. It's a path marked by disciplined budgets, smart debt management, and a profound understanding of the importance of financial mindfulness.

dora app + financial coach = financial success

take control of your finances anytime, anywhere. experience the winning combination of our mobile banking app and free financial coaching for a brighter financial future.